|

|

|

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

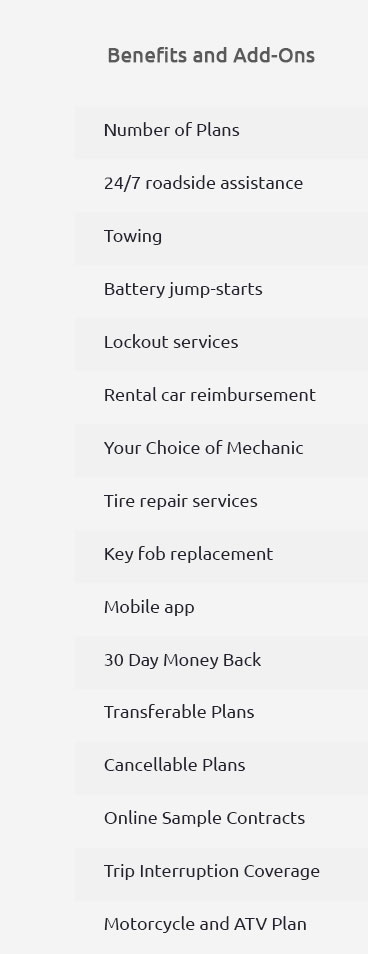

Comprehensive Auto Coverage: A Complete Guide for U.S. ConsumersWhen it comes to protecting your vehicle, comprehensive auto coverage offers peace of mind and cost savings by covering a wide array of potential damages. For many drivers in the U.S., understanding the ins and outs of comprehensive coverage is essential for ensuring your car is protected against unforeseen events. What is Comprehensive Auto Coverage?Comprehensive auto coverage is a type of insurance that covers non-collision-related damages to your vehicle. This includes incidents like theft, vandalism, fire, and natural disasters. While it's not required by law, having comprehensive coverage can save you from hefty repair bills in the event of such damages. Why Consider Comprehensive Coverage?Peace of mind is perhaps the most significant benefit of comprehensive coverage. Knowing that you're protected against a variety of unexpected incidents can be reassuring. Additionally, comprehensive coverage often complements collision insurance, providing a more rounded protection for your vehicle. Benefits of Comprehensive Coverage

What's Covered Under Comprehensive Auto Coverage?

It's also worth considering how comprehensive coverage fits with other types of protection, such as care guard car warranty, which might offer additional coverage options. Exploring Extended Auto WarrantiesIn addition to comprehensive coverage, extended auto warranties can further safeguard your vehicle against unexpected repairs. These warranties often cover specific parts and systems, providing an extra layer of protection beyond standard insurance. Extended warranties can be particularly beneficial for drivers in regions with harsh weather conditions, like the Midwest, where vehicle wear and tear might be more pronounced. FAQsIs comprehensive auto coverage required by law?No, comprehensive auto coverage is not required by law in the U.S., but it is highly recommended for complete protection against non-collision-related damages. How does comprehensive coverage differ from collision insurance?Comprehensive coverage protects against non-collision-related incidents like theft and natural disasters, while collision insurance covers damages resulting from accidents with another vehicle or object. Can I combine comprehensive coverage with other types of insurance?Yes, many drivers combine comprehensive coverage with collision insurance and extended warranties to ensure full protection. Consider exploring options such as car breakdown repair insurance for a broader scope of coverage. In conclusion, comprehensive auto coverage provides essential protection for your vehicle, allowing you to drive with confidence and peace of mind. Whether you're dealing with harsh winters in the Northeast or navigating urban streets, having the right coverage can make all the difference. https://www.allstate.com/resources/car-insurance/what-is-comprehensive-auto-insurance

Comprehensive car insurance is a coverage that helps pay to replace or repair your vehicle if it's stolen or damaged in an incident that's not a collision. https://www.progressive.com/answers/comprehensive-insurance/

Comprehensive insurance coverage is defined as an optional coverage that protects against damage to your vehicle caused by non-collision events that are ... https://www.statefarm.com/insurance/auto/coverage-options/comprehensive-coverage

Comprehensive coverage helps pay to repair or replace a covered vehicle from a loss not caused by a collision.

|